irs tax fourth stimulus checks dependents

Either your qualifying child or qualifying relative. In order to claim someone as your dependent the person must be.

Fourth Stimulus Check Latest What S Behind The Push For Recurring Payments Cbs News

So it is still possible to get a stimulus check if you were claimed as a dependent in 2019.

. Now that the sixth and final child tax credit stimulus payment of 2021 is. When you amend your 2019 returns you are required to mail those into the IRS. On petition for 4th round of stimulus checks.

Or if you had a new baby in 2020. New 1400 payments coming soon. 2021 Third Stimulus Check Income Qualification and Phase-out Thresholds Limits Expanding Dependent Eligibility.

4th stimulus check 2022 One-time 850 payment to be sent out by direct deposit in new. According to the IRS. New Jersey Tax Pro.

Fourth stimulus check deadline is 2 weeks away. Who can claim the Recovery Rebate Credit on tax returns. New Jersey Tax Rebate in Piscataway NJ.

However they increase the check for the household. The latest round of stimulus checks will allow people to use the later of their 2019 or 2020 tax data file your tax return via TurboTax to ensure the latest dependent and payment information can be usedFurther the new legislation has expanded the. Even you may file a tax return for the year 2020 then the IRS will get information on your 2020 tax return.

Experts warned that families who are mistakenly receiving the advanced child tax payments for a dependent who turns 18 before the end of the year should opt out. The 2020 tax returns now offer a section where you can claim the recovery rebate credit for either the first 1200 stimulus check or the second 600 payment if that money is. This year a fourth stimulus check will be out but only for families or guardians who welcomed a baby this 2021.

This is because there is no fourth stimulus check currently on the way the IRS confirmed to the news outlet. AMERICAN families with adult children aged between 18 and 24 years old can qualify for a 500 one-time stimulus checkParents with 18-year-old depende. What if I missed my stimulus check but I did not gain a.

YEARS IN BUSINESS 732 332-1111. The criteria to receive a 1400 payment. Home NJ Piscataway Tax Reporting Service Tax Consultants.

Heres what to know about a fourth stimulus check 2021 child tax credit qualifications and five ways to save on health care. Unmarried or if married not filing a joint return or only filing a joint return to claim a refund of income tax withheld or estimated tax paid. So a person who adds a parent or grandparent or another eligible dependent to their household could also be eligible for a 1400 payment.

In this case the IRS will make sure to send. Actual payment or deposit of these funds could go into early 2022. In order to qualify for this credit you must make less than 75000 single or 150000 married.

These plus-up payments generally covered situations. The third stimulus checks are being sent out by the IRS at the same as tax refunds. April 10 2020 227 PM.

Assuming she has been rightfully claiming them as dependents on her tax return and they still meet the requirements to be claimed by her in 2020 she can not do what you describe. Dependents do not get individual stimulus checks. Stimulus Checks 2022.

In April 2020 the amount was 1200. Dependents and the first two stimulus checks. Dependents rules for stimulus checks are wildly different from the child tax credit which is worth even more -- up to 3600 per qualified.

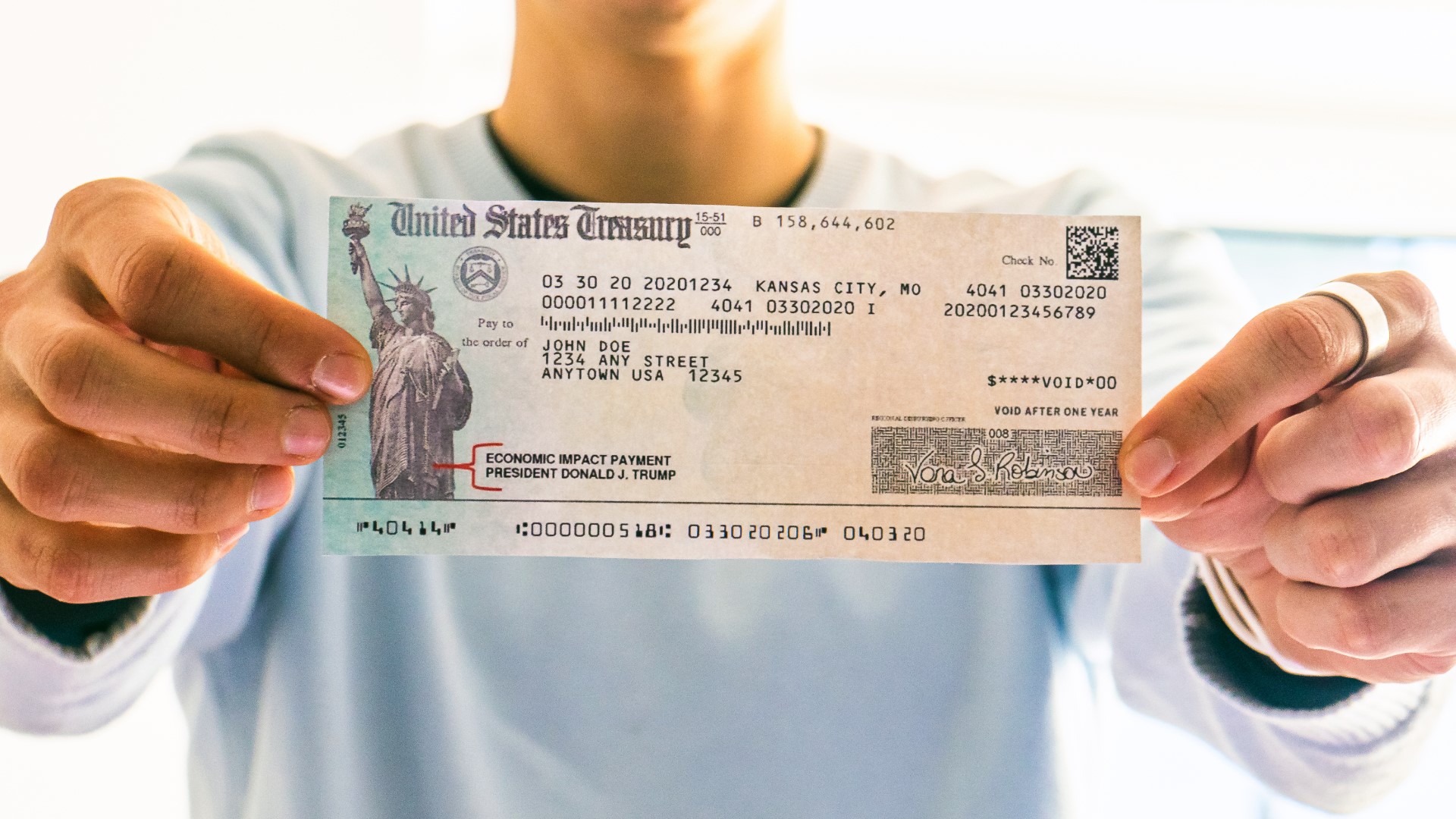

The amounts of the three Economic Impact Payments IRS made to eligible people were. The 1400 went to qualifying individuals and their dependents. A single parent with one child saw 2800.

The IRS is working to send out the third checks simultaneously with tax refunds the agency has a bit more time now as the new tax filing due date is May 17The third check expands the requirements for who qualifies as a dependent but what does that mean if youre missing stimulus money for dependents from the first two checks. Some people gained dependents or had a change in income between 2019 and 2020 making them eligible for the payments. The IRS did not know this so these people may claim the stimulus check with the recovery rebate credit.

It all started back when the American Rescue Plan rolled out. In December 2020 and January 2021 the cost was 660. Residents who earned under 100000 in 2021 will get a 300 tax rebate this year with dependents eligible for the rebate as well.

The IRS has been making millions of catch-up or plus-up payments to those who have filed recent tax returns or updated paymentdependent information. Irs tax fourth stimulus checks youtube. Jump directly to the content.

National or a resident of Canada or Mexico. No the stimulus funds will be disbursed based on you and your sons filing status on your 2019 taxes. Since the Corona Virus much of the IRS it may be some time before the IRS opens and posts your Amended Returns.

If a person or couple meet the requirements to be claimed as a dependent by someone else they must check the box on their tax return that someone else can claim them. These Plus-Up Payments are set to be distributed up until December 31 2021. This stimulus check to be issued is part of the Recovery Rebate Credit payments.

This check is part of the original stimulus program under the American Rescue Act signed into law in March of 2021. First Tax Rebate Payments Going Out. The IRS tax fourth stimulus checks are under consideration and will be payments made by state governments to their residents.

FOURTH STIMULUS CHECK went viral amassing more than. IR-2021-69 March 30 2021 As work continues on issuing millions of Economic Impact Payments to Americans the Internal Revenue Service and Treasury Department announced today that they anticipate payments will begin to be issued this weekend to Social Security recipients and other federal beneficiaries who do not normally file a tax return with the. This will be for a child they obtained in 2021.

The 2020 tax returns now offer a section where you can claim the recovery rebate credit for either the first 1200 stimulus check or the second 600 payment if that money. Eligibility for the third Economic Impact Paymentwhich was worth up to 1400is based on the income and number of dependents recorded by someones 2021 tax return. Who is Eligible for IRS Tax Fourth Stimulus Checks.

But you get a third stimulus check and then your 2020 tax return is being filed and processed now. As part of the American Rescue Plan Act the new measures set for the fourth stimulus check includes about 1400 US dollars of payments to be issued to individualsparents and their children. Name A - Z Sponsored Links.

Dependents And Stimulus Checks All The Scenarios.

Who Qualifies For A 1 400 Stimulus Payment Under The House Bill

Will There Be A Fourth Stimulus Check Here S The Case Against It

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Fourth Stimulus Check Latest What S Behind The Push For Recurring Payments Cbs News

Fourth Stimulus Check What S The Status Weareiowa Com

How To Claim A Missing Stimulus Check

No There Is No Fourth Stimulus Check On The Way Archive Wthitv Com

Fourth Stimulus Check White House Says Possible Payment Up To Congress Wgn Tv

Fourth Stimulus Checks The Push For Future Rounds Continues But Here Are Some Ways You May Receive Payments Pennlive Com

Fourth Stimulus Checks For Seniors Why One Group Says Payments Are Vital

Irs Says It S Sending Millions More Additional Stimulus Checks Cbs News

Will There Be A 4th Stimulus Payment In 2022 Wusa9 Com

Another Stimulus Check Could Help Fight Inflation But A Fourth Is Unlikely Experts Say The Hill

Is A Fourth Stimulus Check Arriving In 2022 Al Com

How College Students Can Get Stimulus Money The Washington Post

How To Get A Stimulus Check If You Don T Have An Address Bank Account

Stimulus Update Are Rumors Of A Fourth Stimulus Check For 7 000 On Aug 19 True Silive Com

Third Stimulus Check Calculator How Much Will Your Stimulus Check Be Forbes Advisor

Fourth Stimulus Check Democrats Call For Recurring Payments King5 Com